Are your bills coming in faster than you can pay them and do you find it difficult to understand your financial situation overall? You’re not alone! By creating a budget and using basic budget categories, you can get back on track with developing healthy financial habits and staying organized with your money.

The Importance of Simplifying Finances

We all know the feeling of being overwhelmed by finances. You may be buried in debt, attempting to find a way out, or constantly worrying about meeting month-to-month expenses.

Regardless of your financial situation, taking some simple steps can help you gain more control over your finances and make life simpler for you and your family.

In this blog post, I will provide practical tips for using basic budget categories. This will enable you to streamline your finances and empower you to take charge of managing your spending more effectively, ultimately leading to a successful budget.

PLEASE NOTE: Disclaimer: The information provided is for educational purposes only and is not to be taken for financial advice. If you need financial advice, please consult a trained expert, such as a financial planner or advisor.

Bookmark on Pinterest!

Basic Budget Categories as a Practical Financial Framework

When it comes to managing your finances, there are several choices and possibilities. Establishing your budget is the cornerstone for taking control of your spending. The simplest way to start is by defining basic budget categories.

From long-term savings goals to everyday spending decisions, having an appropriate structure in place will help you keep track of where each penny goes—ensuring that your income stays on track along with manageable debt levels.

Read on in this post to see why establishing simple budget categories provides effective financial guidance while giving you the freedom to customize them based on personal needs and preferences!

Understanding Basic Budget Categories

By breaking down your expenses into major budget categories such as housing, transportation, food, and entertainment, you can easily see where your money is going each month.

This knowledge allows you to make informed decisions about where to cut back and where to allocate more funds.

Basic Budget Categories and Their Role in Organizing Expenses

By budgeting and using basic budget categories, you can easily see how you’re spending and make adjustments according to your financial priorities.

For example, you may realize that you’re spending too much on eating out and need to cut back on that category to save for other things.

Overall, the concept of basic budget categories is simple yet powerful, providing a roadmap for your finances.

Common Basic Budget Categories

As we go through life, we have to make financial decisions daily. It’s important to understand where we’re spending and how much we can allocate toward each category.

Housing is usually our biggest expense, and finding affordable rent or mortgage payments can be tough. Costs for transportation can add up quickly, especially if you own a car and have to pay for gas, insurance, and repairs.

Groceries are a necessity and the cost varies depending on your diet and where you shop. Utilities and debt payments are another area where costs vary but can be managed through careful budgeting and mindful spending.

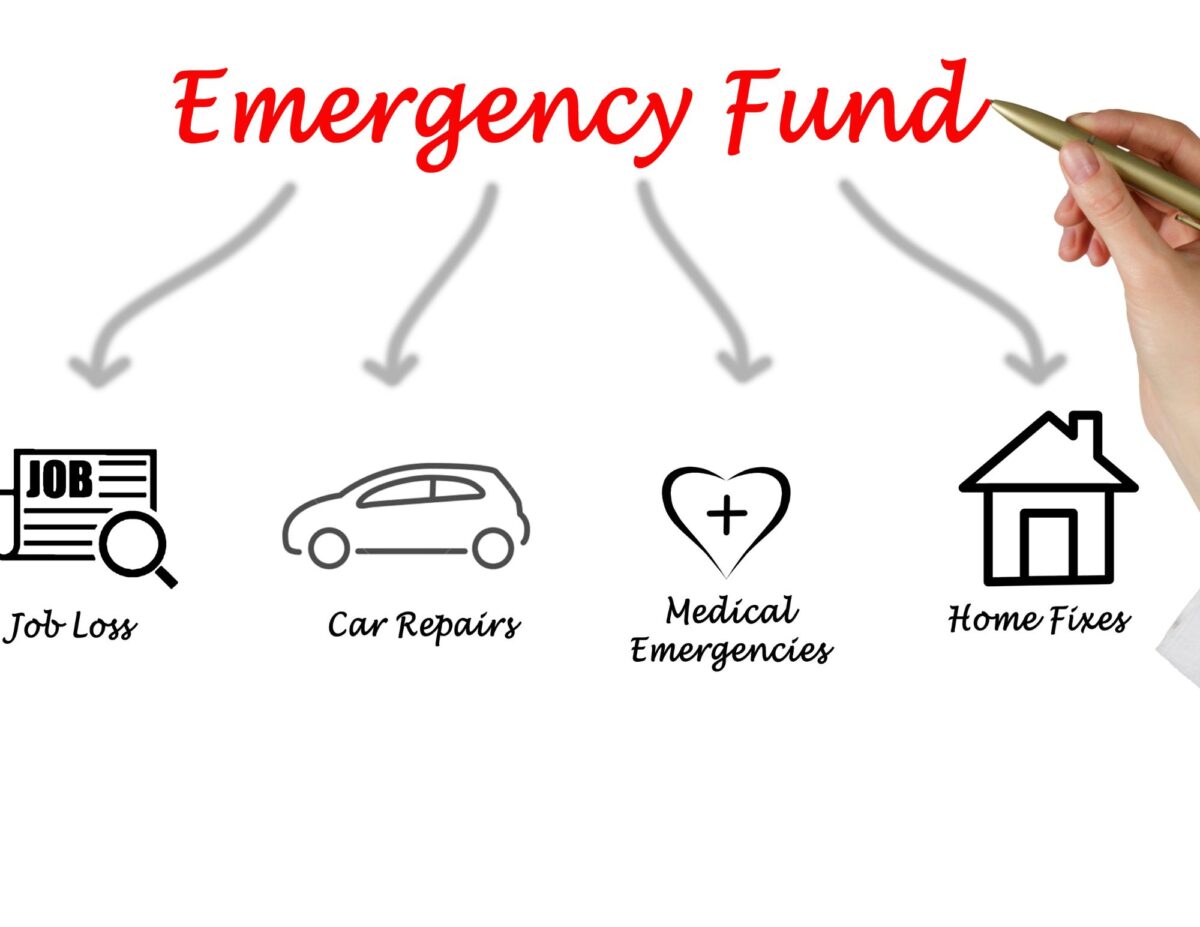

It’s also important to plan for unexpected expenses or emergencies.

Lastly, discretionary spending is the fun part – it can be anything from buying a new outfit to going on a vacation.

By being aware of the common categories of expenses, we can create a budget that works for us and sets us up for financial success.

Benefits of Using Predefined Basic Budget Categories

By having a set list of categories to allocate your expenses, you gain clarity on your spending patterns. This means you can quickly identify areas where you may be overspending and adjust accordingly.

Additionally, with a clear budget in place, you can make more informed financial decisions.

So whether you’re trying to save up for a big purchase or just want to get a better handle on your day-to-day spending, consider using predefined categories to streamline your budgeting process and put yourself on the path to financial success.

Building Your Budgeting Foundation

Once you have a detailed understanding of your finances, you can make more informed decisions about how to allocate your funds.

A well-planned budget is not meant to restrict your spending, but rather to ensure that you’re spending wisely and in the areas that matter most to you.

Step-By-Step Instructions on Setting up a Budget Using Basic Budget Categories

To get started, begin by identifying your income sources and listing out all of your expenses.

From there, you can create personal basic budget categories for your expenses, such as housing, transportation, food, and entertainment. Assign a set amount to each category, based on your income and spending habits.

Continue to track your spending and adjust your budget as needed to stay on track toward your goals. By creating a budget and sticking to it, you’ll feel more confident and in control of your finances.

Guidance on Assessing Income, Identifying Fixed and Variable Expenses, and Allocating Funds to Each Category

Income can come from various sources such as your job, investments, or side hustles.

Once you have a clear picture of your income, it’s important to differentiate between fixed expenses, like rent or car payments, and variable expenses, like entertainment or dining out.

Tips for Adjusting Category Allocations

As we journey through life, our financial goals and priorities are destined to evolve and change.

Whether it’s saving up for a down payment on a house, paying off debt, or planning for retirement, it’s important to adjust our category allocations accordingly.

A good starting point is to take a deep dive into your spending patterns to identify areas where you can cut back. Then, prioritize your goals and allocate your funds accordingly.

For instance, if your priority is saving for retirement, consider increasing your allocation to your retirement account. On the other hand, if you’re saving up for a trip, you may want to cut back on your entertainment or dining categories.

Related Post: Affordable Adventures: 29 Frugal Family Travel Tips

Making the Most of Each Category

By carefully assessing your expenditure patterns, you can identify areas where you may be overspending and make adjustments accordingly.

For instance, taking the time to plan out meals and shop sales can help you save big on groceries every month.

Similarly, cutting out unnecessary streaming services, such as a Netflix subscription, and finding free or low-cost entertainment options can have a significant impact on your overall budget.

Strategies to Optimize Spending and Maximize Savings

Housing is typically the largest expense in a budget, so exploring options like downsizing or refinancing can make a big impact.

Transportation costs can be reduced by utilizing public transportation, carpooling, or even walking and biking. Food expenses can be lowered by meal planning and cutting down on eating out.

By analyzing how we spend money in each category, we can make intentional and effective changes that will ultimately lead to a more secure financial future.

Tips for Minimizing Expenses Within Each Basic Budget Category

By incorporating practical tips to minimize expenses in each category, you can easily save money without sacrificing your lifestyle.

For example, negotiating bills with service providers can help reduce monthly expenses, while meal planning can help you stay within a food budget.

Additionally, taking advantage of free or low-cost entertainment options can help you make the most of your discretionary spending.

Flexibility and Customization of Basic Budget Categories

Whether you need to allocate more funds towards groceries or transportation, having the ability to adjust budget categories to fit your specific needs is essential.

The beauty of budgeting is that it allows you to take control of your finances and make informed decisions regarding your spending choices.

Customizing Basic Budget Categories

Basic budget categories are meant to act as a starting point but can be customized to fit an individual’s needs.

For example, if you have a high transportation cost due to a long commute, it may be beneficial to create a separate category for commuting expenses. Similarly, if you frequently shop for work-related clothing, including a category for work attire may be helpful.

By tailoring your budget categories to your specific financial situation, you can better track your expenses and make adjustments when necessary. Don’t be afraid to get creative and make changes to your basic budget categories, ultimately, your budget should work for you, not the other way around.

Adding Additional Categories or Subcategories Can Enhance Budgeting Accuracy

By breaking down main categories into more detailed categories, you can gain a better understanding of where your money is going and make more informed decisions about where to cut back.

For example, instead of lumping all of your transportation expenses under one category, you could break it down into subcategories such as gas, car maintenance, and car insurance. This level of detail can help you identify areas where you can save money.

Adjusting Category Allocations as Circumstances Change

As we go through life, our financial priorities can shift and change depending on our circumstances. It’s important to regularly evaluate and adjust our category allocations to ensure that our money is being used effectively and in alignment with our current goals.

Maybe you’ve recently started a family and want to shift more funds into the childcare category or perhaps you’ve experienced a change in income and need to redistribute your budget accordingly.

Whatever the reason, making adjustments to your category allocations is a necessary step in staying financially responsible.

Savings and Emergency Fund as a Basic Budget Category

Experian states, “Not only is it [emergency fund] a resource for avoiding debt and maintaining financial security in a crisis, but it can also reduce financial stress to know that you’re covered in an emergency. Experian cites a survey that claims that widespread financial insecurity and inadequate savings exist among American workers.

We all have unexpected costs or emergencies that pop up, and without a solid emergency fund, we may find ourselves facing debt or financial hardship. Setting aside money in a savings account or a fund for emergencies should be a priority in everyone’s budget.

The Importance of Setting Aside Money for Savings and Building an Emergency Fund

It’s essential to set aside money for savings and building an emergency fund. By having a reserve of funds, you can have peace of mind knowing that you have a safety net in case of a financial crisis.

Saving money also enables you to plan for the future, such as for retirement or buying a house, and avoid relying on loans or credit cards. No matter your income level, it is vital to make saving a priority and commit to it regularly.

Determining an Appropriate Amount to Save Each Month

Saving money is always an important priority, but figuring out the right amount to set aside every month can be challenging. Before making any decisions about setting a savings goal, it’s important to consider your income and what your goals are.

These factors will determine how much you should be saving each month. A good rule of thumb is to aim for saving at least 20% of your income – but this number may vary based on your unique circumstances.

With a little planning and discipline, you can establish a monthly savings plan that meets your needs and sets you on the path toward financial success.

List of 11 Basic Budget Categories

Here are 11 basic budget categories you might want to include in your budget:

Housing costs: Include costs related to rent/mortgage payment, property taxes, HOA fees, renters insurance, or home maintenance.

Transportation: Consider costs for vehicle payments, fuel, auto insurance, maintenance, and public transportation.

Groceries and Dining: Allocate a budget for grocery shopping, household supplies, and dining out.

Utilities: Include bills for electricity, water, gas, internet, phone service, and other utilities.

Debt Payments: Account for payments towards credit cards, loans, or any outstanding debts.

Savings: Dedicate a portion of your income as savings for short-term goals, emergencies, or long-term objectives like retirement.

Personal Care: Budget for personal care items, such as toiletries, haircuts, and beauty products.

Entertainment: Set aside funds for leisure activities, hobbies, movies, concerts, or subscriptions to streaming services.

Health and Wellness: Consider expenses related to health insurance, medical bills, medications, gym memberships, or wellness activities.

Education and Personal Development: Allocate a budget for books, courses, private school, nursery school, or any educational pursuits.

Miscellaneous: Account for any other miscellaneous personal spending, such as life insurance premiums or charitable giving, that doesn’t fit into specific categories.

Conclusion to Basic Budget Categories

Taking the time to effectively budget your money is a critical step in financial success. Not only will you have greater control over your money, you’ll be better equipped for the future.

If you liked my blog post, please share on Pinterest:

To get the most out of your budget categories, invest time in researching which categories are right for you and learning how to best adjust them as life changes occur.

With a solid foundation based on sound budgeting practices, there’s no telling how far your money can take you!

The Importance of Basic Budget Categories as a Practical and Efficient Tool for Managing Finances.

Overall, using basic budget categories is a great method for bringing greater order and structure to your finances. When managed responsibly, small lifestyle adjustments can save you more money than expected and help bring stability to spending habits over time.

Additionally, with the help of today’s technology, there are numerous applications available for effectively tracking and managing your budget.

Setting up a budget can be intimidating at first but becoming aware of how much you’re spending and where will put you on the right financial track.

Encouragement to Implement the Concept of Basic Budget Categories

You must take control of your finances and negotiate a budget that makes sense for your situation. Implementing and sticking to the concept of basic budget categories can be an effective tool to simplify your whole approach to money management.

When done correctly, it can help you pay debts on time, save for future purchases, and most importantly give you peace of mind.

The Long-Term Benefits of Budgeting

When it comes to budgeting, it’s easy to focus on the short-term goals and losses. But budgeting is a key part of achieving financial success in the long term.

By carefully monitoring your spending and income, you can set achievable goals that provide relief from financial stress and peace of mind.

Regularly reviewing your budget will give you a better handle on where your money is coming from and where it’s going – something that everyone should strive for as they move toward their financial goals. With dedication and effective budgeting, you can set yourself up for success now, and for years to come.

–YOU MIGHT ALSO LIKE–

Great tips and reminders on budgeting and how to set that up.

Thanks, Tracy!

I actually had a talk with my fiance last week about this. We have been living paycheck to paycheck and I just spent my last dime on rent and we are starting over with-$7 in our account. I downloaded the expense sheet and wrote down all the categories thank you so much for your help!

I know how it is, Alina. I’m so happy that you found my post and tracking sheet what you need to help your finances.

Really helpful, thank you!

You’re welcome, Michelle!

Fantastic budget tips! I have been looking for ways to simplify our saving and budget.

Thanks, Megan! I hope the categories help make your budgeting simpler.

Great, detailed tips! Thanks a lot!

You’re welcome, Caroline!

This is just what I need. I will use what I learned here. Thank you so much.

Fantastic! Thanks for letting me know, Lani!

This is exactly what I needed. Thanks for such great tips

I’m thrilled that you find the info in my blog to be what you need, Fareeha!

Thank you for this post! Important topic that can’t be overstated enough. Especially in times like now.

Thank you!

This is a great post and really helpful for those that are just getting into budgeting. I have been doing it for years and love it, but I know there are many that don’t budget (and should!). It can take time to get into the habit, but it’s so helpful to track your spending and see where things are going. Thanks for sharing!

These are great tips and will be super helpful for people getting into budgeting. Thanks for sharing this informative post.

Great post with helpful tips.

Great tips! Having an emergency fund is vital.

It is an interesting way to organize a budget. I think I’ll try using budget categories to analyze our finances better. Thank you for a great article!

Thanks so much, Olga!

This is really helpful

Thanks! I’m glad you’ve found the post to be helpful!