Welcome to the 52-Week Money Savings Challenge! The purpose of this challenge is to help you to start saving in a fun and manageable way. By following this 52-week challenge, you will have saved a significant amount of money that can be used towards your financial goals.

PLEASE NOTE: Disclaimer: The information provided is for educational purposes only and is not to be taken for financial advice. If you need financial advice, please consult a trained expert, such as a financial planner or advisor. Please read my full disclaimer.

The Concept of the 52-Week Money Savings Challenge

This concept is quite simple – each week of the year corresponds to putting away the dollar amount of that week. Stick with me to learn how a small weekly contribution can grow your savings significantly without too much effort.

You can bookmark on Pinterest!:

The Benefits of Participating in This Challenge

By participating in the 52-Week Money Saving Challenge, you can experience a variety of benefits. These include:

- Increased savings: By following this challenge, you will save over $1,300 in just one year.

- Easy and manageable: The challenge follows a simple and easy-to-follow formula, making it an achievable goal for anyone.

- Develop good saving habits: This challenge can be a great way to develop healthy saving habits.

- Motivation and accountability: The challenge provides a clear goal and structure, making it easier to stay motivated and accountable throughout the year.

- Flexibility: While the traditional challenge involves increasing the amount saved each week, you can also customize it to fit your financial situation. For example, you could save a fixed amount each week or choose a different formula altogether.

Overall, participating in the 52-Week Challenge can lead to increased savings and improved financial habits, making it a beneficial endeavor for anyone looking to improve their finances.

How the 52-Week Money Savings Challenge Works

The goal of the challenge is to save a total of $1,378 by the end of the year.

Break Down the Weekly Savings Plan, Starting From Week 1 to Week 52

The challenge is simple: save a little bit every week for 52 weeks. Starting the first week with just $1, the second week with $2, and the third week with $3. Each week increases by $1 until you reach week 52, where you save $52.

When you complete the challenge at the end of the year, you will have saved $1,378! Whether you’re saving up for something specific or just want to build up your savings account, this challenge is a fun and effective way to make it happen.

Some people start the challenge as a New Year’s resolution, but you can start anytime. Start small and watch your savings grow week by week with the 52-Week Money Saving Challenge.

Choosing Your Starting Point

The great thing about the 52-Week Money Saving Challenge is that you can start at any time during the year.

Flexibility of the Challenge and How you Can Choose the Starting Point

One of the best things about the 52-week money saving challenge is its flexibility. You can choose the starting point based on your financial capacity.

Whether you’re starting at the beginning of the year or in July, the challenge is designed to help you accumulate extra cash by the end of the year.

Don’t worry if you don’t have a lot of extra money to start with – even starting with just a few dollars a week can add up over time.

Weekly Savings Structure

The 52-Week Money Savings Challenge follows a simple structure – with each week representing a different amount to be saved.

The Incremental Approach of the Challenge

Saving money is no easy feat, but with a structured approach, it can become a habit. The incremental approach of the weekly savings challenge is a great way to see your savings grow gradually over the year.

With this method, you start small and increase your savings incrementally every week. The idea is to begin setting aside a small amount that won’t be missed, and then slowly increase that amount every week.

By the end of the year, you’ll have saved a substantial amount without feeling like you’ve made a huge sacrifice.

Small Contributions can Lead to a Significant Sum by the End of the Challenge

Even small contributions can add up over time and result in a significant amount saved.

The key is to be consistent and disciplined in putting away a small amount every week. By the end of the savings challenge, you will be surprised at how much you have accumulated.

Tips for Success

Tips for success include: setting realistic goals, sticking to a budget, tracking your progress, and staying motivated.

Practical Tips to Help You Stay Committed Throughout the Year

If you’re looking to make a long-term change in your saving habits, a weekly savings structure might just be the way to do it. But as with any new habit or routine, it can be tough to stay committed week after week.

One great way to do this is by setting reminders on your phone or computer, or by marking a physical calendar with your progress. Additionally, consider finding an accountability partner – someone who can encourage and motivate you along the way.

I use my debit card while shopping to get a few extra dollars for savings without paying any fees. That’s how I accumulated money for my emergency fund.

Strategies for Overcoming Potential Challenges or Setbacks

Setbacks can happen, such as unexpected expenses or forgetting to save one week. This is where having strategies for overcoming these challenges can be helpful.

One strategy is to create a budget that includes your savings goal so that you’re aware of how much you need to save each week. Another strategy is to have a designated bank account and use automatic transfers to ensure you don’t forget to save.

You can set up a high-yield savings account or interest-earning checking account which will help you make even more money. Credit unions are a good financial institution to look into for a good interest rate.

Finally, always remember your end goal and the benefits that come with saving – financial security and peace of mind.

Related Post: Mastering Your Money With Basic Budget Categories

Customizing the 52-Week Money Savings Challenge

The 52-Week Money Savings Challenge is a great way to save, but it doesn’t have to be limited to just 52 weeks. You can customize the challenge to fit your own goals and needs.

Personalize the Challenge

Whether you’re aiming to accumulate emergency savings, plan a dream vacation trip, or save for the holiday season, tailoring this challenge to your needs will help keep you motivated and on track.

Consider adjusting the amount you save each week based on your income and expenses, or adding in bonus contributions when you have extra cash on hand.

Variations or Modifications to Suit Individual Preferences

Here are a few ways you can modify the 52-week saving challenge to better suit your preferences and lifestyle:

- Same Amount Saving Challenge: If you don’t want to keep track of different amounts for different weeks, you can save $26.50 each week and it will come out to the same amount, $1378 for the year.

- Reverse Challenge: Start with the highest amount in week one and work your way down to the lowest amount in week 52.

- Bi-weekly Challenge: Instead of saving weekly, save every two weeks.

- Dollar Increase Challenge: Rather than increasing the amount saved by $1 each week, increase it by a larger amount such as $5 or even $10.

- Savings Goal Challenge: Set a specific savings goal and allocate the weekly amounts accordingly.

Remember, there is no right or wrong way to do this challenge. The key is to find a method that works for you and helps you achieve your goal.

Tracking Progress

Tracking your progress is an important aspect of the 52-week savings challenge.

Suggestions for Tracking and Celebrating Progress

When it comes to the 52-week saving challenge, tracking progress is key to reaching your goal.

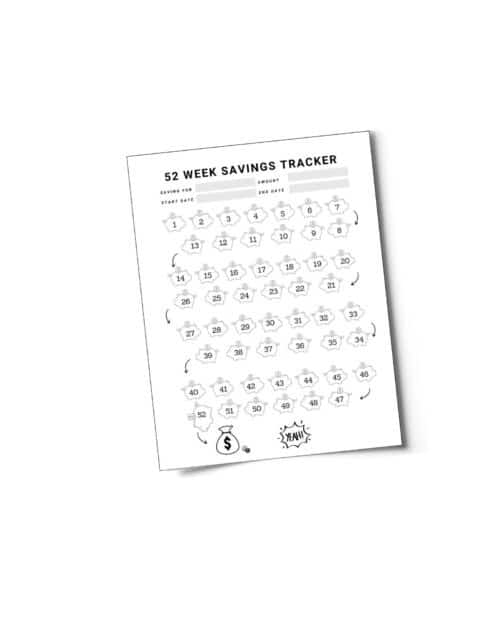

One suggestion for tracking progress is to create a chart or spreadsheet outlining each week’s savings amount and check it off once completed. A savings tracker not only keeps you accountable but also provides a visual representation of your progress.

Additionally, celebrating milestones can be a great motivation boost. Maybe you treat yourself to a small reward after reaching every $500 milestone or go out to dinner to celebrate reaching halfway through the challenge.

Not only does this make saving more fun, but it also reinforces the positive habit you’re building.

Tools or Apps That Can Help You Stay Organized

Sticking to a savings plan can be challenging, but staying organized can make all the difference. You can use a saving challenge app to help you keep track of your progress.

One great tool is Timely Bills, which allows you to create a budget and tracks all of your investments. Another useful app is PocketGuard. It helps you track expenses and keep track all of your balances securely.

And if you prefer a more hands-on approach, you can always use a simple spreadsheet to track your progress week by week. Whatever method you choose, staying organized and keeping track of your savings will help you stay on track and reach your goals in the year ahead.

Get a FREE 52-Week Money Savings Tracker:

Encouragement To Participate

Saving money can be tough, but participating in the 52-week savings challenge is a great way to develop good financial habits and reach your savings goals.

Motivation to Embark on the Challenge With Enthusiasm

While it may seem daunting at first, with each week that passes, you’ll become more confident in your ability to save. By the 52nd week, you’ll have not only a significant amount saved but a newfound sense of discipline and accomplishment.

Small, Consistent Efforts Lead to Significant Financial Achievements

Every dollar you save is a step closer to your goal amount. And while it may seem like small amounts at first, over time these savings will add up significantly.

The 52-week savings challenge is all about consistency and making small efforts each week to build towards your larger goal.

Conclusion to 52-Week Money Savings Challenge

Money-saving challenges are an easy way to kickstart your financial journey and develop good money-saving habits.

Key Points of the Blog Post

In conclusion, the 52-week savings challenge is a creative way to achieve your money goal without too much money.

By following the simple steps of choosing your starting point, creating a weekly savings structure, and tracking your progress, you can set yourself up for success on this journey.

Whether you choose to save more or less each week the important thing is that you are taking action towards improving your financial well-being.

If you liked this post, please share on Pinterest:

Start Your 52-Week Money Savings Challenge Today

Now that you have all the information you need, it’s time to take action and start your own 52 Week Money Savings Challenge. Don’t hesitate to make any adjustments or modifications that will better suit your financial situation.

Remember, this challenge is completely customizable and can be tailored to fit your needs. Get started – the sooner you start the 52-week Money Savings Challenge, the sooner you’ll reach your financial goal.

–YOU MIGHT ALSO LIKE–

Wow! Great ideas here. Have to think of how to do this myself

Thanks, Elaine!

I love the ease of this challenge! For someone who finds it hard to save, this seems super doable. We are trying to get better at saving in my household so we can finally buy that land we dream of. Thanks for the article!

You’re welcome, Desiree! Good luck with getting that land!

this really helps. i have started mine already. thanks for sharing

You’re welcome!

Love the simplicity of this and how it shows the cumulative impact of saving in so many ways

Thanks, Vidya!

I love this idea! Such a great way to really boost your savings. I’m saving for a house, so this is a really helpful idea.

I’m glad you found the challenge a helpful idea toward saving for your house, Christine!

Great tips and a helpful reminder for me to get started this year! I did a similar challenge a couple of years ago and I am motivated to do it again 😄 thank you for sharing!

You’re welcome, Jasmine! Good luck with your savings challenge!

I love this idea! I really need to start saving money in a more manageable way.

Thanks, Shannon!

Great tips! Since becoming an SAHM, I have been exploring more ways to save money; I have gained more from this post. Thanks for sharing!

Thanks, Tiffany! I’m so glad you found the post helpful!

Brilliant idea to save some money all year long. My father-in-law does a version of this for Christmas gifts each year. He starts adding a little each week to an envelope so holiday gifts aren’t as overwhelming.

Thanks Debbie! And your FIL sounds like a money-wise man!

This challenge looks quite manageable and should help me save quite a bit of money this year. The total I would save would go a long way in paying for holiday gifts and a few other expenses that always pop up at the end of the year.

Yes, saving for the holidays is a great way to use the money from the challenge, Sarah!

This 52 money-saving challenge sounds really exciting. I`m in! We planned a big family trip in 2025, and we would like to save some money. Thank you for cool idea.

You’re welcome, Olga! I’m so glad you like the money challenge!

I will be trying this! It’s a great fit with my goal of being more self awareness with my finances. 😀

Great, Selene! I wish you much success on your saving goal!

This is a good, gradual way to build up savings and the amounts are small enough each week that most anyone can afford. Best of all, a challenge like this helps develop a savings habit. Once someone completes this, they are likely to continue and save even more the following year.

Yes, completing this challenge gives great satisfaction and the probability of continual savings, Bryan!

Here’s to you, the visionary architect behind the 52-Week Money Savings Challenge – may your blueprint for financial success inspire countless individuals to take charge of their financial future and thrive!

That’s my hope, Julie!

Great saving money challenges, I love these types of challenges. We are doing a similar to this but shorter. Thank you for sharing!

You’re welcome, Fransic!

Great way to save money. I’m passing this information on to my kids.

Thanks, Kelly!

I love these types of plans when I see them. They are really simple and easy if you can keep yourself disciplined about it. I’ve managed to save a bit with similar approaches. Thanks for sharing!

You’re welcome!

This is such a great way to get started building for the future! At the end of the year, you can turn around and invest that money and keep it going!

Yes, that is a great idea, Beth!

Love the idea of this challenge! Some great ideas that I can easily incorporate throughout this year. The tracker is most helpful!

I’m glad you found the post and tracker helpful, Stephanie!

I want to try this challenge because life with two kids is getting expensive now. Plus we need a new car and patio.

Yes, every day prices keep going up, Olga! I wish you success on the challenge!

This plan is a great way to save money. Sometimes it’s hard because there are so many temptations.

Yes, it can be a challenge to not be tempted with so many possible items to buy, Richard.

What a great way to build up your savings! Thanks for the idea.

You’re welcome, Luna!

Wow, interesting, love this challenge. Saving money for some people might not be easy but with this, make it fun and easier. I’m saving this to try as well. Thank you for sharing!

Good luck on the challenge, Fransic!

This challenge always felt daunting to me for some reason, but your explanation of the 52 week money savings challenge really makes it seem easy! I need to save up for a new laptop as mine no longer supports the latest window updates!

That’s a good reason to take up the challenge, Julie.

Great tips on saving money, it’s so challenging at this time of year!

Yes, it certainly is, Alana!

Awesome! I started the challenge this year!

Wow, that is awesome! Good for you, Jarrod!